Independent, Fee-Only

Why Us?

-

Individually Tailored Portfolio Management

As a result of completing a thorough financial planning process, your investment portfolio will reflect your unique needs, circumstances, and goals.

-

Experience

AKM Advisory's Principal, Adam K. Mans, has over twenty years investment experience. In addition to his M.B.A. in finance from the University of Minnesota, Adam has earned two well respected professional designations, Chartered Financial Analyst (CFA) and Certified Financial Planner™ (CFP®), from the CFA Institute and the Certified Financial Planner Board of Standards, respectively. Please see their websites at www.cfainstitute.org and www.cfp.net for additional information regarding these designations.

-

Investment Discipline

AKM Advisory's emphasis is on a long-term, academically based and cost effective approach. Maintaining discipline through widely varying market environments, both good and bad, is often the difference between success and failure in investing.

-

Service

AKM Advisory is committed to a high level of client service. By working with a relatively small number of clients, AKM can offer very personal and highly responsive relationships.

-

Integrity

Putting clients' interests first is not merely the right way to do business, it's required of AKM Advisory in multiple ways. First, as a registered investment advisor (RIA), AKM is required to adhere to a fiduciary standard with respect to all of its clients.

Additionally, both the CFA and CFP® designations require adherence to their own codes of conduct. Please see the CFA Institute's Codes, Standards, and Guidelines; and the CFP Board's Standards of Professional Conduct for additional information.

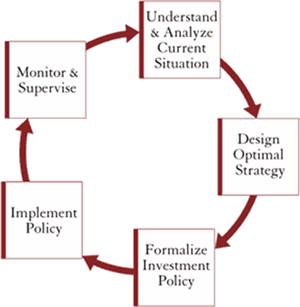

Our Process

- Understand and analyze current situation

- Design optimal strategy

- Formalize Investment Policy Statement

- Implement policy

- Monitor and supervise

The result of this process is an individually tailored, all weather investment strategy that satisfies two important considerations:

- Investment Issues – The strategy should make good investment sense given your:

- Assets

- Cash Flows

- Investment Time Horizon

- Financial Goals

- Behavioral Issues (Risk Tolerance) – The strategy's pattern of returns will not cause you to abandon the strategy during the widely varying market environments, both good and bad, that you will experience during your investment time horizon.

Fee Structure

AKM Advisory charges a fee based on a percentage of assets under management. As a fee-only advisor, AKM is compensated solely by its clients and does not receive any compensation that is contingent on the purchase or sale of a financial product. The fee structure is as follows:

- 1.00% on the first $1,000,000

- 0.75% on the next $500,000

- 0.50% on the balance of the relationship

Fees are calculated and billed quarterly, in arrears, based on the average daily balance of the relationship.

The preferred minimum relationship size is $500,000.